Simple message: China is still buying oil and other commodities. So the drop in their price can't be due to China.

Second: China's equity markets are a tiny percentage of the world total and very few foreigners are invested in them. So how could the swooning markets be China's fault?

Third: all currencies, not just the Chinese yuan, have fallen against the US dollar. How can that be China's fault?

Fourth: it is US consumers, not Chinese, who drive global consumption.

Read on for more by Jake...(or see below fold):

Second: China's equity markets are a tiny percentage of the world total and very few foreigners are invested in them. So how could the swooning markets be China's fault?

Third: all currencies, not just the Chinese yuan, have fallen against the US dollar. How can that be China's fault?

Fourth: it is US consumers, not Chinese, who drive global consumption.

Read on for more by Jake...(or see below fold):

Why do Hongkongers listen to bores who say that China’s to blame for global market woes?

PUBLISHED : Monday, 11 January, 2016, 10:32pm

UPDATED : Tuesday, 12 January, 2016, 10:36am

UPDATED : Tuesday, 12 January, 2016, 10:36am

Business

JAKE’S VIEWJAKE VAN DER KAMP

To point a finger at China makes no sense when it comes to weak commodity and stock prices

Shares, crude oil prices and currencies in Asia, the United States and Europe fell during the first week of this year amid investors’ concerns about Beijing’s ability to keep the equities and Chinese currency under control.

SCMP, January 9

I would be very grateful if someone could explain to me a thing I do not understand.

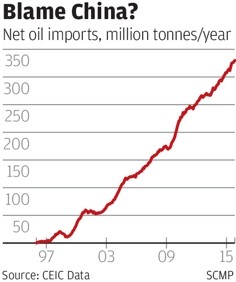

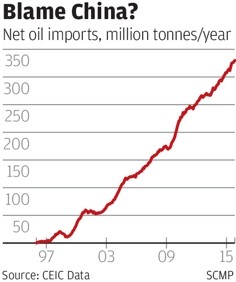

How is it in any way China’s doing that crude oil prices are falling when China’s net imports of crude oil have risen from virtually nil 20 years ago to more than 300 million tonnes a year now and are still growing strongly at almost 10 per cent year over year?

The chart tells you the story. It’s just straight along growth with nary a sign of that much talked of slowdown. And what is true of oil is true of most other commodities. The prices are way down but China’s imports are still steady or even up in volume terms. Falling commodities prices can thus not be attributed to anything happening in China.

The same observation can be made about shares. How is it China’s doing that stock markets are weak in Europe and America? China’s equity market has only very recently been opened to foreigners and then only to a limited extent through a barely navigable Hong Kong channel that few big investment funds have found attractive.

The stock market weakness in Shanghai and Shenzhen can thus not have had a cross-infection effect on other world markets. In fact, given the evidence of heavy capital outflows from China at the moment, it is more likely that private Chinese investors have helped prop up European and American markets. There should be more thanks than blame here.

And how is it possibly China’s doing that most currencies around the world are weak against the US dollar? Yes, the yuan has also weakened recently but US dollar has risen by some 20 per cent against its trade basket since mid-2014 and this says that there are plenty of currencies weaker than the yuan out there. Try the Canadian dollar, ouch.

In any case, China conducts its foreign trade in US dollar terms, not yuan, and publishes yuan equivalents only as an after-thought. Beijing would like the yuan to be an international currency of trade but all the self-congratulation of having achieved this ambition has very suddenly vanished over the last few weeks. China’s rising appetite for commodities, especially crude oil, suggests that the blame game for weak commodity prices belongs elsewhere.

China’s rising appetite for commodities, especially crude oil, suggests that the blame game for weak commodity prices belongs elsewhere.

China’s rising appetite for commodities, especially crude oil, suggests that the blame game for weak commodity prices belongs elsewhere.

China’s rising appetite for commodities, especially crude oil, suggests that the blame game for weak commodity prices belongs elsewhere.

And it is certainly not as if Chinese consumers drive the world trade cycle. This distinction belongs mostly to American consumers. China cannot force them to buy or stop buying. All it can do is serve them when they want to buy. Why then this game of blame China for the world’s economic troubles?

The answer is very simple. European and American commentators on world affairs are never going to admit that the fault lies at home when it so much easier to blame their troubles on foreign doings. And one obvious target comes easiest to mind in difficult times.

Thus let us get it straight. European countries are in economic difficulties largely because they broke all their own rules for the formation of the European Union while at the same time fooling themselves that these rules protected the stronger members of the union who advanced money to the weakest. It’s self-inflicted.

And the United States is in difficulties because it fooled itself that dropping money from helicopters (Ben Bernanke’s own words for it) could magically pull the US out of any recession. It has not worked.

But the people responsible for all this in both Europe and America are not prepared to look in a mirror for the real culprits. They find it much more convenient to focus a long telescope on China.

The mystery to me, however, is wh