|

| Check *that* out! From the FT |

Ant Financial is a spin off from Alibaba, the world's largest online retailer (no, the largest is not Amazon...). Grafting the finance company to an online retail company is a uniquely Chinese thing and is set to make it the largest company in the world.

Consider that in one 24-hour period last November Alibaba and Ant did $US 25 billion in turnover, over one billion U.S. dollars per hour, 17 million a minute....

This is one of the "becauses" in answer to the "whys": why is China burgeoning and why is it now one of the most interesting countries in the world.

I've thought and said before that you can divide the world into two*: the builders and the destroyers. The builders broadly include the West and Asia - mainly China. And the destroyers are pretty much all the countries making up the OIC.

Check out the chart above from the article below in the Financial Times. How freaking amazing is *that*!? Where China is compared to the rest of the world. It's China first, daylight second.

———-

*Mao Tse-tung said "yi fen wei er (一分为二)” One divides into two. His rip-off of Hegelian dialectics. But think of it: male and female, left and right, Liberal and Labour, Republican and Democrat. Those who divide the world into two and those that don't....

The article is here ($) or below the fold.

China's Ant Financial shows cashless is king

The article is here ($) or below the fold.

China's Ant Financial shows cashless is king

The payments company has quickly become one of the most valuable in the world, but could face obstacles abroad

Don Weinland in Hong Kong and Sherry Fei Ju in Beijing

When Alibaba founder Jack Ma carved out his payments business from the ecommerce giant in 2010, he pulled off a coup with multibillion-dollar implications.

Suggesting that the Chinese government would not allow foreign investors to control a central part of the country's payments system, he told Yahoo and SoftBank — then Alibaba's biggest shareholders — that they could no longer have a stake in the Alipay business. Instead, Mr Ma took complete control of the new company.

The true impact of this manoeuvre became apparent this week with the news that Ant Financial, the Alibaba financial arm that grew out of the original Alipay business, is preparing to launch a $9bn private fundraising round ahead of its much anticipated initial public offering, according to people familiar with the matter.

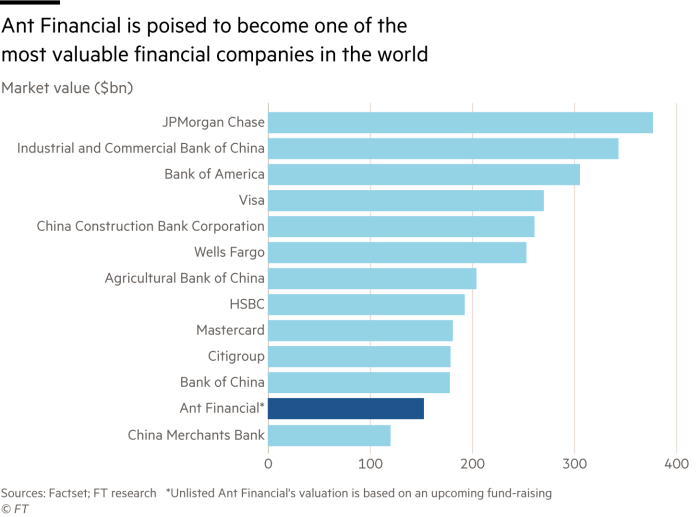

That fundraising is expected to give Ant Financial a jaw-dropping valuation of around $150bn, making it the world's most highly valued unlisted technology group. To put it into perspective, that means that investors believe Ant Financial is worth 50 per cent more than Goldman Sachs.

Coinciding with the heightened tension over a possible US-China trade war, the news underlined the emergence over the past decade of a generation of Chinese technology companies that have the scale, expertise and firepower to compete with US rivals.

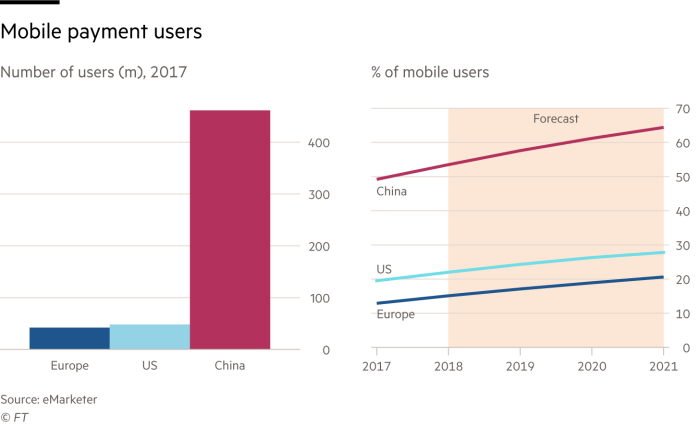

The Ant Financial story also demonstrates the way that China, the second-biggest economy in the world, has embraced the shift towards a cashless society more enthusiastically than Europe or the US. Consumers used Alipay last year to make $8.7tn in payments, according to Barclays.

"These companies are like Facebook if it had a bank on top of it and everyone had a bank account [with Facebook]," says Joe Ngai, managing partner for greater China at McKinsey. "There is really nothing like this in the west."

Ant Financial is one of the most striking symbols of the last decade of Chinese capitalism. With $230bn under management the company has the world's largest money market fund. It controls one of the largest credit scoring systems in the world, collecting data on its hundreds of millions of users in China. Now a multinational which has inked deals around the world, its operations also include a bank, an insurer and a lending platform for small businesses.

To investors, eager to take part in the fundraising, including Temasek, the Singaporean investment fund, the company is a proxy for China's economic future.

Ant Financial is now one of the backbones of consumption in China. Including its rival Tencent, the two companies make up more than 90 per cent of the country's $16tn annual mobile payments market.

The company benefits by being part of the broader Alibaba empire, which is blazing its own trail in ecommerce. Since 2009, Alibaba has held Single's Day, a digital shopping festival to promote spending on the Hangzhou-based company's online mall, called Taobao. At the event last year, which featured appearances by actor Nicole Kidman and musician Pharrell Williams, it approached $25bn in online sales in a 24-hour period.

Those sales are conducted on Alibaba's shopping platform, but the payments for most of the purchases are made through Ant Financial. Analysts describe Alipay as the glue that holds together Alibaba's online shopping empire.

Alipay started as an online escrow service in 2004 that allowed merchants and shoppers to send and receive payments but, more importantly, it gave shoppers a means to claim back refunds if they felt cheated on a sale, providing a shimmer of confidence in a marketplace devoid of trust.

The $150bn valuation will lift Ant close to the $168bn market capitalisation that Alibaba achieved when it launched its record-breaking $25bn IPO in 2014. Analysts say the valuation is based on far more than just Ant's online payments; their attention, rather, is on its ubiquity in China and its ability to utilise the data of daily life.

The evidence of its business and that of Tencent are visible on nearly every street corner in cities around China. In Beijing, Shanghai or Shenzhen, young people seldom use cash to pay for coffee, fast food or even daily groceries. Instead they scan two-dimensional QR bar codes with their phones that process the payment via Alipay or Tencent's WeChat Pay.

"In China most of the offline daily consumption scenarios, such as dining, transportation, beauty, convenience stores, have been enabled with mobile payment via QR code scanning," Gregory Zhao, an analyst at Barclays, wrote in a report earlier this month.

Mr Zhao valued Ant Financial at $155bn based on a projection of net operating profits after taxes of $11.7bn by 2021. Increasingly, Ant's income will be generated not by Alipay but by the other units in its portfolio, such as its money market fund and its lending operation, he says.

Yu'E Bao, the money market fund, highlights the breakthrough nature of some of Ant's businesses. When it was launched in 2013, it allowed customers to move their balances on the payment platform — as little as Rmb1 ($0.16) — into a fund paying interest as high as 7 per cent. Within a year it had taken in Rmb570bn in assets under management to become China's largest money market fund, and last year it was crowned the largest in the world.

Sesame Credit, Ant's credit scoring business, pulls data from users across its spectrum of businesses, including information about which users buy what, who repays debts and which clients save more than others. That data can be analysed by the company's lending platforms, which give loans to both consumers and to small businesses. By better understanding their customers, analysts say Ant Financial is able to make more profitable lending decisions.

Alipay and WeChat Pay are fighting bitterly for the future of these markets. But Alipay has retained a strong lead with 54.3 per cent of mobile payments at the end of 2017 compared to WeChat Pay's 38.2 per cent, according to research group Analysys.

"Competition is intensifying as the biggest players jostle among themselves and face off with smaller start-ups, but everyone will be taking a piece of a bigger pie because the market is growing so much," says Adrian Seto, Accenture's senior director of innovation and financial technology in Asia-Pacific.

Talk of Ant's valuation is a painful reminder to Yahoo, now controlled by Verizon, of its loss of the company.

Yahoo bought a 40 per cent share of Alibaba for $1bn in 2005. In early 2011, Alibaba announced that the US internet group's investment no longer included Alipay, which had been surgically removed nine months earlier from Alibaba and set up in a separate company under the control of Mr Ma.

Yahoo's share price fell by nearly 10 per cent in a single day following the news. Analysts at the time calculated that Alipay made up about $1.7bn of Yahoo's $24bn market value. Mr Ma chalked up the move to regulatory requirements from the Chinese government. The restructuring was necessary at the time, he said, because the presence of foreign investors could have held up the allotment of a payments license to Alipay.

An agreement was eventually reached where Alibaba was guaranteed 37.5 per cent of the future profits of Alipay or a payment of $2bn-$6bn in the event of an IPO, something that continued to give Yahoo exposure to Alipay. Under its new valuation, a 40 per cent stake in Ant Financial would now be worth $60bn.

The legacy of the incident lives on as Ant Financial prepares to take on new foreign investors through private funding and an eventual IPO.

The FT reported last year that Ant had pushed back its planned IPO to late 2018 or 2019 due to problems securing regulatory approvals. To allow crucial payments infrastructure to potentially fall into the hands of foreign investors, Ant will need an explicit blessing from Beijing — something that has yet to materialise in the public domain.

The fact that Temasek plans to invest in Ant in the new fundraising round suggests that the company could be closer to getting approval for having major foreign investors on its register.

Despite its dramatic growth within China, Ant Financial's efforts to expand overseas have been much slower — and in some cases have faced the same issue that caused its bust-up with Yahoo.

Since 2015 it has bought or made significant investments in 11 overseas companies, according to data from Thomson Reuters. In Pakistan, for example, Ant announced plans in March to buy a microfinance institution for $184m. The same month it said it would spend $200m on a media group in India.

Recommended

But its biggest overseas gambit collapsed in January when its $1.2bn bid for Dallas-based payments group MoneyGram International was blocked by US regulators. The buyout would have made Ant an important player in the US payments system. However, fears over a Chinese company controlling the personal financial data of US clients ultimately killed the agreement.

"That's a huge hit to their confidence," says one banker close to the deal. Eight years after the move to squeeze out Yahoo from Ant, it was also a reminder that politics can hinder Mr Ma's plans for the company outside of China.

Additional reporting by Lucy Hornby in Beijing

Sent from my iPhone